In the dynamic world of cryptocurrency trading, particularly with meme coins, Smart Money and Copy Trading are two strategies that traders often use to gain an edge. While these methods can provide valuable insights and opportunities, they also come with risks that require careful consideration. This blog explores the concepts of Smart Money and Copy Trading, their benefits and risks, and how to use them effectively to navigate the volatile crypto market.

What Is Smart Money in Crypto?

In the context of crypto trading, Smart Money refers to institutional investors, funds, and influential whales who have extensive market knowledge, experience, and access to exclusive information. These entities often hold significant amounts of tokens, giving them the power to influence market movements.

Benefits of Following Smart Money

- Early Opportunity Identification:

Smart Money frequently spots promising tokens before they gain mainstream attention, allowing observant traders to get in early. - Market Insight:

Tracking Smart Money movements can provide insights into potential market shifts or upcoming catalysts. - Learning Strategies:

Observing their trading patterns helps retail traders learn and adopt successful trading strategies.

What Is Copy Trading in Crypto?

Copy Trading allows investors to replicate the trades of successful traders in real-time. This strategy is particularly popular in the meme coin market due to its accessibility and potential for quick profits.

Benefits of Copy Trading

- Access to Expertise:

Novice traders can benefit from the knowledge and strategies of experienced traders. - Time-Saving:

Copy Trading eliminates the need for constant market monitoring and analysis. - Diversification:

By following multiple traders, investors can diversify their strategies and reduce risk.

While Copy Trading offers access to experienced strategies, it comes with risks. Even successful traders can make mistakes, leading to potential losses. Additionally, it requires giving up control over investment decisions, which may not suit every trader. High volatility, especially in meme coins, can amplify risks, making careful selection of traders and strategies essential.

Recommendations for Using Smart Money and Copy Trading

To make the most of these strategies while minimizing risks, follow these recommendations:

1. Conduct Thorough Research:

Before following Smart Money or copying a trader, review their track record, trading style, and performance history.

2. Start Small:

Begin with a modest investment and gradually increase as you gain confidence in the strategy.

3. Diversify Your Approach:

Don’t rely solely on one strategy or trader. Spread your investments across different assets and methods.

4. Use Risk Management Tools:

Set stop-loss orders and limit the amount you invest in each trade to manage risk effectively.

5. Stay Informed:

Keep up with market trends, news, and regulatory developments that could affect the crypto landscape.

6. Be Cautious with Meme Coins:

Remember, meme coins are highly speculative and often lack intrinsic value. Approach them with caution.

7. Leverage Analytics Platforms:

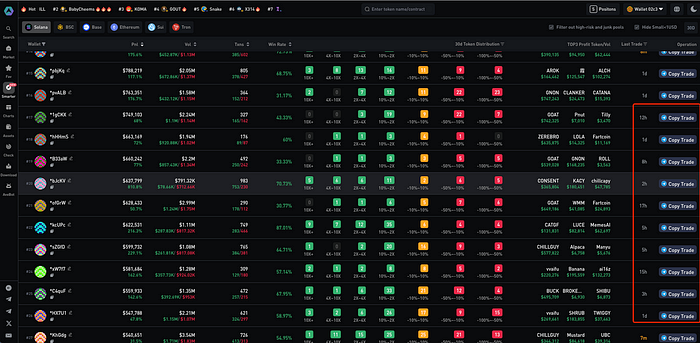

Use tools like ave.ai, the leading on-chain analytics platform, to gain deeper insights into Smart Money activities.

8. Understand the Technology:

Learn the basics of blockchain and the fundamentals of the cryptocurrencies you’re trading.

9. Maintain Objectivity:

Avoid emotional decisions or falling prey to FOMO (fear of missing out). Stick to your plan.

Key Takeaway: Balancing Risks and Rewards

Smart Money and Copy Trading strategies can open doors to new opportunities and insights in the cryptocurrency market. By tracking the moves of seasoned investors and leveraging the expertise of experienced traders, you can potentially enhance your trading outcomes. However, both strategies come with inherent risks that require careful management.

Always remember that the crypto market is highly volatile, and no strategy guarantees success. As with any investment, only trade with funds you can afford to lose. With a balanced approach and informed decisions, Smart Money and Copy Trading can be valuable tools to navigate the exciting but unpredictable world of crypto trading.